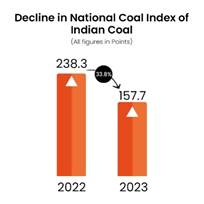

Newdelhi:26/7/23:The National Coal Index (NCI) has shown a significant decline of 33.8% in May 2023 at 157.7 points compared to May 2022, where it was at 238.3 points, which indicates a strong supply of coal in the market, with sufficient availability to meet the growing demands.

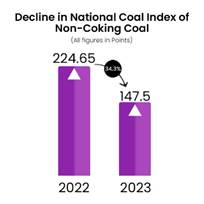

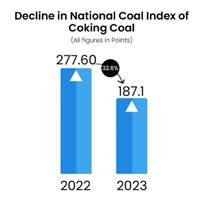

Similarly, the NCI for non-coking coal stands at 147.5 points in May 2023, reflecting a decline of 34.3% compared to May 2022, while coking coal index stands at 187.1 points in May 2023, with a decline of 32.6%. The peak of NCI was observed in June 2022 when the index reached 238.8 points. However, subsequent months have experienced a decline, indicative of abundant coal availability in the Indian market.

The National Coal Index (NCI) is a price index that combines coal prices from all sales channels, including notified prices, auction prices and import prices. Established with the base year as fiscal year 2017-18, it serves as a reliable indicator of market dynamics, providing valuable insights into coal price fluctuations.

Additionally, the premium on coal auctions indicates the pulse of the industry, and the sharp decline in coal auction premiums confirms sufficient coal availability in the market. India’s coal industry affirms a substantial stockpile, with coal companies holding impressive stock. This availability ensures a stable supply for various sectors dependent on coal, significantly contributing to the overall energy security of the nation.

The downward trend in the NCI signifies a more balanced market, aligning supply and demand. With sufficient coal availability, the nation can not only meet the growing demand but also support its long-term energy requirements, thus building a more resilient and sustainable coal industry.

Odisha news today, Latest Oriya News Bhubaneswar Online Odia news Portal

Odisha news today, Latest Oriya News Bhubaneswar Online Odia news Portal